12 months ago, Adam Posen first set out his arguments for more policy stimulus in the UK. As the economy has slowed, evidently Posen's conviction has grown and his demands have become more forceful. In a speech yesterday, he berated UK policymakers for their inertia and claimed they were repeating the errors of the 1930s. A quick glance at Posen's bibliography, which runs to 4 pages, suggests Paul Krugman has heavily influenced his opinions - no bad thing in Macro Maestro's view. Still, MM can imagine the way Posen's boss, Mervyn King, responded to this criticism - "In my office, now!".

Generally, Macro Maestro finds Posen's (Krugman's) diagnosis convincing. He also accepts part of the Posen cure, namely additional gilt purchases designed to support asset prices. But Posen also recommends ‘credit easing’, in which the Bank and the Treasury would set up a new bank to lend directly to small and medium-sized enterprises (SMEs). This, he claims, would boost business investment and support overall demand.

Unfortunately, there is little evidence tight credit conditions are holding back capital spending. Pointing to weak lending growth proves nothing. While business investment has posted a weak improvement compared to previous recoveries, lacklustre expected demand seems the most likely cause of this. Why would the corporate sector start spending more aggressively while households and the government sector are deleveraging? Investment is ‘derived demand’ – companies only invest if they expect future demand to be healthy. Indeed, as the chart below shows – UK business investment usually only grows when consumer spending growth is healthy (e.g. exceeds 2%).

Moreover, in aggregate, the UK corporate sector (excluding financials) is in good health. Profitability has remained strong – despite labour hoarding during the downturn – and the sector has been a net lender (i.e. borrowing less than it lends) for much of the past decade. This suggests firms do have the resources to invest in new capital, but can’t find profitable enough opportunities. Uncertainty about the future is clearly playing a critical role. There are lots of ways to measure this but perhaps the simplest is to look at the MPC’s fan charts for future GDP growth. As the chart below shows, these are currently the widest they have ever been , based on a standard deviation of almost 2.

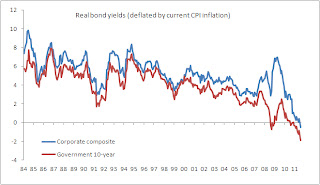

MM also reminds his readers (both of you) that the real cost of capital is very low by historical standards. So even taking into account wider spreads, it’s hard to see how funding costs are a constraint on the corporate sector overall. Unless credit easing can make businesses more confident about the future, it seems unlikely to have any meaningful influence on the macro economy. Far better to use QE, which by raising asset prices, has a better chance of raising wider sentiment (for a while at least..)

No comments:

Post a Comment