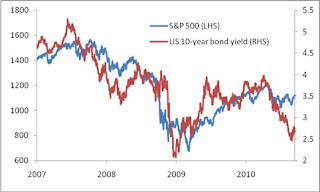

During the summer, bond and equity markets started to diverge:

10-year yields in many advanced economies (including the UK, US and Germany) fell to their lowest levels since the depths of the financial crisis (and in some cases their lowest levels on record), while equity prices have generally held up. Of course, there are a few exceptions to this, notably within EMU (Greek, Irish and Portuguese yields have risen back towards their May 2010 peaks).

Such sharp divergences between bonds and equities are unusual. Early 2008 was the last time this occurred, when the yield curve inverted (signalling recession) and stocks tried to shrug this off. Macro Maestro remembers talking to investors at the time and there were stark differences in opinion, even within the same financial institution. In general, ‘bond types’ were talking about deep recession, liquidity traps and even depression while equity investors believed the sub-prime crisis would be relatively contained. (We know how that worked out..)

This time there seem to be several possible explanations:

1. Perhaps the most benign possibility is that central banks are depressing bond yield by talking about further monetary stimulus. Another round of global QE should depress bond yields and, if successful, support future growth (and hence equity valuations). As evidence, we should note Ben Bernanke set out the Fed’s remaining policy options in an August speech. Goldman Sachs are now forecasting another round of US asset purchased by the end of the year.

2. Some claim the bond market is a better leading indicator that equities. In this scenario, the global economy is about to experience a ‘double dip’ recession and the equity market is simply mispriced. This was the case in 2007-08. Still, bond investors seems to be taking a significant gamble. Recent US data have been soft, but certainly not at recessionary levels. (Euro-area indicators are still consistent with above-trend GDP growth.) Current levels of yields seem more consistent with a Japanese-style deflationary environment – this is certainly not something Macro Maestro would be comfortable forecasting with such conviction, particularly as it relies on the complete breakdown in private sector confidence. (Is such a thing forecastable?) Still, the recent decline in 10-year spot yields (at least in the UK) does seem to have been driven by the inflation expectations component (see chart below – based on BoE data):

3. There is a bubble in bond markets. After a two-decade rally in bond prices, investors are getting carried away and buying bonds purely as a momentum trade. A minor example of this occurred in late 2002, when the original Ben Bernanke ‘plan B’ speech triggered a sharp, temporary drop in bond yields. As it turned out, deflation concerns were largely a hoax.

Macro Maestro isn't convinced by 1. With the exception of Goldman's Jan Hatzius, most investors/economists reacted to Bernanke's speech with a 'is that it?'. So that leaves 2 or 3. Macro Maestro belives 3 is a more compelling explanation than 2 - the bond market's utter conviction in deflation is difficult to justify. But that doesn't mean Macro Maestro isn't worried about the global growth outlook..

Macro Maestro isn't convinced..

ReplyDelete